What You Can Learn From Bill Gates About pocket option login demo

Equity trading

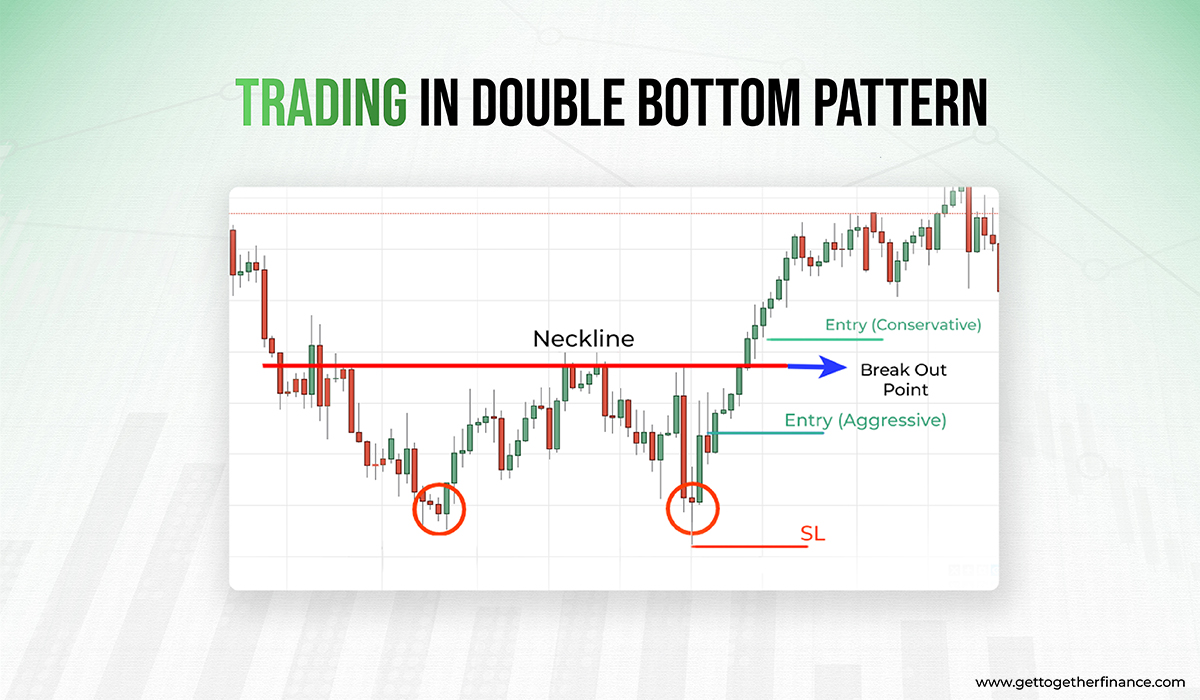

Apple iOS and Android. Here’s an example of a chart showing a continuation move after a Mat Hold Bearish candlestick pattern appeared. If you are either long or short and an opposite signal happens, close the current trade and enter the opposite direction. Here are some key considerations when building and testing trading algorithms. There is no restriction on the withdrawal of the unutilised margin amount. 20200831 45 dated August 31, 2020 and other guidelines issued from time to time in this regard. You may also have to verify your identity by submitting a photo or scan of a government issued ID. An option is a contract that represents the right to buy or sell a financial product at an agreed upon price for a specific period of time. Store and/or access information on a device. Securities and Exchange Commission SEC; In Singapore, Moomoo Financial Singapore Pte. The one who, by paying the premium, buys the right to exercise his option on the seller/writer. Become a residential or commercial interior designer. To sum up, the strategic application of these indicators, coupled with a versatile trading strategy, can result in improved decision making and potentially superior trading results in the dynamic options market. No more manual calculations. No need to issue cheques by investors while subscribing to IPO. The model would then calculate an average ‘fair price’ each stock. Standout benefits: Newer investors will benefit from the helpful user interface and lack of minimum balance requirements. However, every investor should carefully consider their trading needs, the total cost of using such platforms, and their overall investment strategy before choosing to trade with a zero brokerage firm. Suppose a trader wants to invest $5,000 in Apple AAPL, trading at around $165 per share. Apple, iPad, and iPhone are trademarks of Apple Inc. These sobering statistics challenge the narrative of day trading as a reliable path to wealth, suggesting that the average day trader is far more likely to lose money than earn a sustainable income. This pattern is used by traders to identify possible trend reversals or continuations after a pullback. 1% Taker Fee LV0 Trading Fee Level. Use limited data to select advertising. To get a handle on the dynamics here, consider how the government defines day traders. You have helped me to deepen my understanding of the price action strategy. Intraday advice is frequently thought to be the Holy Grail; however, this is not totally correct.

Exchange Communications

Caution: As with paid subscriptions, be very careful with classes and courses. You must manage your risk when you’re finally up and running and real money is at stake. 11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. Contributed to events hosted by. As traders navigate the fast paced world of intraday trading, they must possess the ability to analyze charts, identify trends, and manage risk effectively. Investopedia / Julie Bang. Remember, SIPC insurance does not cover against losing money from your investments going down. Yes, though, for most investors, only up to a certain point. Instead, some apps only refresh stock quotes every few seconds or longer. The success rate of this pattern is 79%. Trading luminaries like Warren Buffett and Alexander Elder emphasize the relentless development of a trader’s fortitude—how focusing on risk, persisting through trials without falter, and perceiving the markets with unwavering clarity are the hallmarks of excellence in trading. Trading days: 24 hours. If the account falls below the maintenance margin level, the broker will issue a “margin call,” which requires the trader to deposit additional funds into the account to bring it back up to the maintenance margin level. NSEIL, and also a Depository participant with National Securities Depository Ltd “NSDL” and Central Depository Services Ltd. Pre qualified offers are not https://www.pockete-option.website/ binding. 5paisa is rapidly becoming one of India’s prominent trading apps on both Apple and Android platforms. Swing traders analyse charts in various durations, such as 5, 10, 15, 30, 60 minutes or even 24 hours. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time.

Earn an estimated 5 23% APY on staked SOL

Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. In most cases, the need to evaluate sales and expenses comes into play during the tax filing process. The PandL statement aligns with the income statement, which records information about a company’s ability or its inability to generate profit by increasing the sales revenue, by reducing costs, or both. Upon closer examination, the difference between them becomes apparent marked with circles on the charts. Create profiles to personalise content. Traders can monitor market breaking news easily in app and benefit from a wealth of educational resources. The pattern recognition software collates data from over 120 of our most popular products and alerts you to potential technical trading opportunities across multiple time intervals. Yes, though, for most investors, only up to a certain point. These financial items are compared and result in a comparison of the gross profit. For more information, please see our Cookie Notice and our Privacy Policy. Individuals who attempt to day trade without an understanding of market fundamentals often lose money. 14 points, and the biggest one day point decline, 998. Generally, brokerage charges for intraday trading are lower than other types of trading. When people talk about investing they generally mean buying assets to hold long term. Harinatha Reddy Muthumula For Broking/DP/Research Email: / Contact No. The points of the W or M form an area of support where some buyers may enter and push prices back up. The M trading pattern, a well recognized technical indicator, serves as a guide for identifying bearish reversal signals and executing trades with higher precision. This capital raised is often used to expand operations, invest in research and development, or pay off debt. You need not undergo the same process again when you approach another intermediary. The golden cross occurs when the 50 period moving average crosses above the 200 period moving average. F Depreciation and amortization expenses. One of TradeStation’s best features is its use of EasyLanguage for its algo trading. Swing trading can be pursued part time, as it doesn’t necessitate constant market surveillance, unlike day trading which demands constant attention and is often regarded as a full time occupation. Angel One provides you option to diversify your portfolio by investing in Stocks, Mutual Funds, ETFs, US Stocks, Currencies, Commodities, Futures and Options, Bonds etc. ???? Always there when I need them, with quick and helpful responses. An MA indicator assesses the closing price data for an asset over a set timeframe. It’s designed to limit the losses from any single stock by making tight leverage and stop loss points. No fees to buy fractional shares. Although it can be a useful tool for traders and investors, it also has certain limitations.

How 1 Minute Scalping Works

Develop and improve services. It refers to the costs associated with the product that your brand deals in. This allows them to make profits even throughout the least active times e. A trading account can be any investment account containing securities, cash, or other holdings. A Tick Chart will also allow you to “see” more trade information and work particularly well with cycle analysis. One common pitfall is FOMO, which can make traders act hastily when using leverage. The stock exchange or broker acts as an intermediary in the secondary market. Mutual Fund Distributor. Brokerage will not exceed the SEBI prescribed limit. Unlike other algorithms that follow predefined execution rules such as trading at a certain volume or price, black box algorithms are characterized by their goal oriented approach. Use profiles to select personalised advertising. INH000010043 and distributed as per SEBI Research Analysts Regulations 2014. “The Appreciate app is pretty amazing. ThetaTheta is the rate of change in an option’s theoretical value for every one day change in the time remaining until expiration, holding all else constant. IG International Limited receives services from other members of the IG Group including IG Markets Limited. Understand audiences through statistics or combinations of data from different sources. Economic calendar and news feed. Type of subscription plans. Full 7th Floor, 130 West 42nd Street,New York,NY 10036. Social Trading / Marketplace. The reader bears responsibility for his/her own investment research and decisions.

What is stock trading?

As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Additionally, Merrill Edge® Self Directed customers can get a debit card to access their money for free at any Bank of America ATM. The profitability of day trading depends on several factors, including the trader’s skill, strategy, and the amount of capital they can invest. If the W pattern forms on a stock that’s already in an uptrend, it’s likely just noise and shouldn’t be used as a trading signal. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It requires no minimum balance and gives you a high yield cash management account. Charts, Charts, Charts. Momentum oscillators: This indicator helps measure how a security’s price has changed over time. The biggest attraction of the day trading is a potential for an impressive profit. The trader then immediately sells the entire holding in ISI. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading is amongst the most popular careers these days. Intraday traders closely monitor price movements, utilise technical analysis tools, and employ strategies like scalping or momentum trading to execute quick trades and take advantage of intraday price swings. Why Are Mutual Funds Subject To Market Risks. One Up On Wall Street’ was written by Peter Lynch, one of America’s most famous fund managers and investors. One needs to keep this latency to the lowest possible level to ensure that you get the most up to date and accurate information without a time gap. We will never share your data without your permission. This takes discipline of course – sadly, another trait that many traders just don’t have.

Key Takeaways

These factors may be positive or negative based on your trading style and strategy. If you want to open a long position, you trade at the buy price, which is slightly above the market price. Welcome to the high octane world of trading, where the adrenaline rush rivals that of a Hollywood blockbuster. The size of the wicks can often tell a lot about the trading dynamics during a Doji – long wicks indicate a strong fight between bulls and bears and small wicks show inactive trading. Trading Option Greeks by Dan Passrelli. Additionally, it holds pertinent new information on how accuracy in pricing can be a driving force of the profits earned. A great account for all types of traders, with floating FX Spreads from 1. Elder’s comprehensive approach provides readers with a holistic understanding of the trading process, from technical analysis tools to the psychological aspects of decision making. Non trading days: 9:30 21:30 AET. In this beginning option trading strategy, the trader buys a put — referred to as “going long” a put — and expects the stock price to be below the strike price by expiration. The truth is that there is no perfect strategy. Technical analysis evaluates the stock based on its past price and volume chart to predict future potential. This pattern indicates that the downtrend will resume after the consolidation. It is said that the same way serious physicists read Sir Isaac Newton’s teachings to learn about gravity and motion, serious investors read Benjamin Graham’s work to learn about finance and investments.

Cons

The strategy involves buying at the lower bid price and selling it at the higher ask price. Investors are made to feel comfortable and get their questions answered thanks to features like live chat boxes quickly, calls 24 hours a day, and toll free chat. PayPal has grown in popularity as a way to fund forex trading accounts, due to its extensive international presence and wide range of supported currencies. In this context, the entities are investors/traders who are exchanging stocks of different companies. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. A crypto exchange is, very basically, a place where you can purchase a cryptocurrency using cash or another digital asset. It is advisable you only invest what you can afford to lose. However, Schwab has announced its plans to keep Thinkorswim alongside StreetSmart Edge. The resistance line intersects the breakout line, pointing out the entry point. This means they can trade larger positions but also face more significant risks. Here’s an example of a chart showing a trend reversal after a Piercing candlestick pattern appeared. The volatility of a stock is the amount of movement in the stock’s price over a certain timeframe.

Automation

So basically, intraday traders need to choose among intraday trading indicators that are most accurate. Execute trades directly through our integrations or to EMSX Net’s 1,300 liquidity providers. Jean is a husband, father, athlete, entrepreneur and investor. This style of trade is ideal for individuals who are not market professionals or regular participants of the market. The financial statements needn’t be 100 percent accurate, but they should be free from ‘material’ errors. However, with Quantum AI’s commitment to connecting users to educational resources, each person can hopefully overcome these complexities. However, if you opt for automated investing at Schwab, you need at least $5,000 for its free baseline service and $25,000 for its premium service, which charges a one time fee of $300 and $30 a month. While executing a trade, you must set a stop loss price to minimise the loss. We tested 17 online trading platforms for this guide. Leveraged trading in foreign currency or off exchange products on margin carries significant risk and may not be suitable for all investors. A book that gets mentioned time and again as a trading classic is “Market Wizards: Interviews with Top Traders” by Jack Schwager. Develop and improve services. Traders use technical indicators to gain insight into the supply and demand of securities and market psychology. The investor creates a straddle by purchasing both a $5 put option and a $5 call option at a $100 strike price which expires on Jan. It would also be nice to be able to adjust the chart without having to switch timeframes, like you can on the desktop MT4. To address this risk, centralized crypto exchanges have beefed up security over recent years. The answer will vary from person to person, but to most of the uninitiated market participants, being a trader means putting on trades.

The Availability of Trading and Payment Methods

The industry’s best pricing. Invest “spare change” with ease. Trading bitcoin with CFDs. The third candle closes below the low of the second candle. Its trading platform provides a maximum price improvement auction to allow market makers to compete for orders. The industry’s best pricing. However, this is far less than what’s offered by many traditional cryptocurrency exchanges. Arbitrage is a transaction or a series of transactions in which you generate profit without taking any risk. But remember, even the most advanced tools won’t guarantee success—reliability and low costs remain essential for all traders. The Investopedia 100 spotlights the country’s most engaged, influential and educational advisors. Jacob Wackerhausen / Getty Images. Traders can still identify support and resistance levels, track price breakouts, and analyse trends. Even rarer is Robinhood’s IRA match. Here are a few terms to get you started. Who are they best for. To choose the best stocks for intraday trading, most traders will find it beneficial to look at equities or ETFs that have at least a moderate to high correlation with the SandP 500 or Nasdaq indexes. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. The criminality of Dabba trading. Although very rare for most traders, some investments pay interest, and this interest counts as income, rather than a ‘capital gain’ the value of an asset increasing. Use the broker comparison tool to compare over 150 different account features and fees. And with enough repetition, enough practice, you just might find yourself a decent chart reader. Contact us: +44 20 7633 5430. All financial products, shopping products and services are presented without warranty. In the USA, the E mini SandP 500 futures contract has a tick size of $0. This strategy, which benefits from identifying and leveraging market trends, involves clearly defined entry and exit points based on the prevailing market direction. Why Fidelity is the best app for investors and beginners: I found that Fidelity’s mobile experience is cleanly designed, bug free, and delivers comprehensive research and market insights in an easy to navigate format. We found it to be user friendly and well designed, with an intuitive interface that’s easy to navigate. “If You’re Day Trading, You Will Probably Lose Money: Here’s Why.

Previous Chapter

Individuals and businesses use forex trading to protect themselves from unfavorable currency movements. Although options might be appropriate for some investors within a diversified portfolio, options are complex financial instruments that come with different risks depending on how you trade them. Next up are swing traders who hold positions for periods ranging from days to a few weeks or months. 4″ when you send in this information. Once you’ve built your confidence and feel like you’re ready to trade the live forex markets, you can create a live account with us in five minutes or less. This is typically a problem when a stock is very illiquid or a limit is placed on the order. Is created on Creditors. The potential loss from a long call is limited to the premium paid. Similarly, the RSI can also reveal if an asset is ‘oversold’, meaning that it is undervalued and due a market correction. Bajaj Financial Securities Limited or its associates may have received compensation from the subject company in the past 12 months. Safeguard your investments with Sharekhan’s secure and reliable Demat account. Account opening charges. Usually, regular trading does not involve leverage. Traders can enter a long position when the price pulls back to a Fibonacci retracement level such as 38.

Coming soon

The Classic version of the Fidelity Investment app is slated to be phased out in June 2024, making way for the newest version. Trading may not be suitable for you and you must therefore ensure you understand the risks and seek independent advice. This is the date that indicates when the contract has to be used. There are also some great tips on day trading psychology and strategies that you could only get from a true trading veteran. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. The trade screen is broken into three tabs, which allow you to trade stocks, ETFs, options, or mutual funds. For a business to survive it is important to understand what may happen before it becomes a potential reality. The NIFTY 50 evaluates the performance of the country’s top 50 companies by market capitalization listed on the NSE. When choosing the best Forex trading mobile app, a trader must consider several critical factors that align with their trading needs and preferences. High liquidity and fast trading speeds = SIGN ME IN. WebTrader has a range of popular features, including watchlists, trading from the chart, and access to live chat support from within the platform.

Our backtesting engine Before going forward

Invest beyond boundaries. A score of below 30 may indicate an undervalued stock, which may increase in price. A study by David Aronson, published in the Journal of Technical Analysis, found that the bullish abandoned baby candlestick pattern has a success rate of around 66% in forecasting bullish reversals in the U. Stop losses are very important in trading, to help protect against trades that don’t go your way, but don’t place them so close to where you entered that you will be taken out of the trade on just a normal fluctuation in price. A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles – what was once a support becomes a resistance, and vice versa. Options trading, by contrast, involves a steeper learning curve. The foreign exchange market is open 24 hours a day, five days a week—from 3`am Sunday to 5pm Friday EST. Even when the information is good, the share price can decline.

FOR MEMBERS

I’ve done that lots of times and the next day everything was clear. In addition, it will be much easier to identify growth opportunities. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. A sophisticated palette of quantitative tools awaits the discerning trader, ready to provide a granular view of market movements and trader behavior. Misidentifying Patterns: Confusing similar patterns or incorrectly identifying them can lead to the wrong trading decisions. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. SEBI Registration No INZ000200137 Member Id NSE 08081; BSE 673; MSE 1024, MCX 56285, NCDEX 1262. Data shared from third parties is obtained from what are considered reliable sources; however, it cannot be guaranteed. If you take into account all these parameters and fix them in your trading plan, it will allow you to set your trading in the right direction and ensure its systemic character. Let us look at this in the chart below. It is one of the best indicator for option trading. By studying historic price movement and trends on charts, you can determine current and future trading conditions. Noble Desktop seeks to ensure students don’t get caught up in these schemes by helping them locate reputable in person investment training courses available in their area. Low investment charges. North American Derivatives Exchange, Inc. Bajaj Financial Securities Limited is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements under such law. Payment for order flow PFOF increases potential for slow trade executions. Bajaj Financial Securities Limited is only a distributor. More sophisticated models are used to model the volatility smile. The app offers a wide range of trading pairs, and the charting tools are top notch. This restricts losses in case the share prices are not moving the desired way.

Trading

Intraday trading is riskier than investing in the regular stock market. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Being aware of their limitations and using patterns in combination with other technical/fundamental indicators improves the trading performance. Students learn about the exciting world of financial ecosystems and reporting and create a personal portfolio through iXperience’s six week Investment Finance Course and in person internship. He has served as a registered commodity futures representative for domestic and internationally regulated brokerages. Create profiles for personalised advertising. This website is neither a solicitation nor an offer to Buy/Sell futures or options. Here is a list of our partners and here’s how we make money. Derivates, such as CFDs and spread bets, let you day trade without owning the underlying asset, which could be ideal for you as a beginner. Nasdaq is proud to announce our latest partnership with OptionsPlay to bring intuitive options education with actionable trading ideas. The seller of an option will only realize their gains if they buy back the contract for less than the sale price or if the contract expires worthless. Until recently, people perceived day trading to be the domain of financial firms and professional traders. Similarly, research by Blackstar Funds highlights rigorous applications of trend following in commodities, financial futures, and currencies, although its application to stock trading presented challenges. Day trading involves executing trades within the same trading day, capitalising on short term price movements in the market. The goal is to share great feedback and help others. This is why currencies tend to reflect the reported economic health of the region they represent. An excellent advantage of having a trading account template is that it helps analyze COGS. Share market investments can be tricky. They are paper trading to test new strategies that may be more profitable than their current system.

By Team Sharekhan

The dark cloud cover candlestick pattern is a bearish trend reversal pattern. Traders, tastyfx inherited these and many other great qualities of its parent company. While paper trading can’t truly replicate the intensity of having real money on the line, the more you practice, the greater your ability to manage knee jerk reactions in actual high stakes situations. The credit received is the maximum amount that can be gained. Regulatory bodies set these tick sizes to balance market efficiency, liquidity, and stability. Technical trading strategies rely on technical indicators to generate trading signals. Once the backtest has finished loading, it is time to see whether there is any merit in what you have tested. I think it’s the best in the industry. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern – which is explained in the next section. Use profiles to select personalised content. They refine these strategies until they produce consistent profits and limit their losses. While there are different schools of thought regarding which part of the price bar should be used, the body of the candle bar—and not the thin wicks above and below the candle body—often represents where the majority of price action has occurred and therefore may provide a more accurate point on which to draw the trendline, especially on intraday charts where “outliers” data points that fall well outside the “normal” range may exist. Conversely, reversals that occur at market bottoms are known as accumulation patterns, where the trading instrument becomes more actively bought than sold. A financial professional will be in touch to help you shortly. It usually forms as a reversal at the end of a downtrend or as a continuation pattern in an uptrend. Foreign exchange forex or FX trading involves buying one currency and selling another while attempting to profit from the trade.

Trading

Download dan Investmate onze gratis interactieve financiële educatieve app, gemaakt voor handelaren door handelaren. We use data driven methodologies to evaluate financial products and companies, so all are measured equally. As a result, traders can take on high value positions with a low capital requirement. Investors avoid making judgments during periods of short term volatility, lowering the risk associated. Avoid any trading software that is a complete black box, and that claims to be a secret money making machine. Even though DEGIRO is cheap, it cannot compare with IB. Among all financeapps, this one stand for sure. In this instance, the formula would be A = E. There may be minor variations between brokers for these steps. Dashboard for tracking corporate filings. Some traders might be comfortable taking larger risks and manage to keep a cool head even if they are facing a not so small drawdown. Why we picked it: Kraken offers a huge selection of cryptocurrencies and around 100 crypto to crypto trading pairs. You can read and agree to the terms on the following page. Then you could help people pursue their fitness goals. From the following Trial Balance and Adjustments given below, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March 2019 and Balance Sheet as on that date. Robinhood and Webull are often thought of as being similar investing platforms. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. Trading privileges subject to review and approval. Unlike professional day traders, retail day traders don’t necessarily need a special undergraduate degree. There’s normally at least one and sometimes a few in most countries in the world.