Understanding Gearing Ratios: Types, Calculations, and Impact

The result indicates its financial leverage or how much of its operational debt is serviced via shareholders’ equity and/or borrowed funds. It’s a strong measure of financial stability and something an investor should keep an eye on. Financial analysts commonly use the gearing ratio to understand the company’s overall capital structure by dividing total debt into total equity. Thus, hindering growth is more of a hindrance to the company’s development. In addition, there are other formulas where the owner’s capital or equity compare against the long-term or short-term debt. Moreover, gearing ratios play a critical role in mergers and acquisitions (M&A).

Ways Companies Manage Their Gearing Ratio

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Our Next Generation trading platform offers Morningstar fundamental analysis sheets, which provide quantitative equity research reports for many global shares. These sheets help to support your fundamental analysis strategy and can provide a guideline for measuring a company’s intrinsic value.

- High ratios may be a red flag while low ratios generally indicate that a company is low-risk.

- Thus, while both ratios are financial metrics, they highlight different aspects of a company’s financial status.

- Companies with high gearing may face higher interest rates due to the perceived risk by lenders.

- It also includes other interest-bearing liabilities such as pension obligations, lease liabilities, etc.

What is the capital gearing ratio?

Companies can issue new equity to reduce reliance on debt, thereby lowering their gearing ratios. This strategy not only improves the balance sheet but also enhances investor confidence by demonstrating a commitment to financial prudence. Gearing ratios come in various forms, each offering a unique perspective on a company’s financial leverage. By examining these ratios, stakeholders can better understand the balance between debt and equity in a firm’s capital structure. A high gearing ratio typically indicates a high degree of leverage but this doesn’t always indicate that a company is in poor financial condition.

Gearing vs. Risk

A higher Interest Coverage Ratio indicates that a company can comfortably cover its interest payments, suggesting lower financial risk. For example, an Interest Coverage Ratio of 4 means that the company’s EBIT is four times its interest expense, providing a cushion against potential earnings volatility. This ratio is crucial for lenders and investors as it helps assess the company’s solvency and its capacity to service debt without compromising operational efficiency. As interest expense is tax deductible in most jurisdictions, a company can magnify its return on equity by increasing the proportion of debt in its capital structure. However, increased debt level increases the risk of bankruptcy and exposes the company to financial risk.

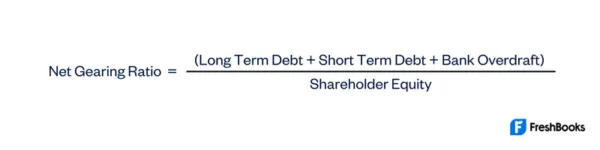

While both gearing and debt ratios measure a company’s financial leverage, they focus on different aspects of a company’s financial structure. The gearing ratio, commonly known as the debt-to-equity ratio compares a company’s debt to its shareholder’s equity (total assets – current liabilities). On the other hand, the debt ratio looks at a company’s total liabilities (both short-term and long-term) and compares it to its total assets. Both ratios provide insights into a company’s financial risk and stability but from different perspectives. Also called the debt-to-equity ratio, this metric provides significant insights into a company’s financial leverage.

Other Uses for Gears

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Capital-intensive companies or those with a lot of fixed assets, like industrials, are likely to have more debt versus companies with fewer fixed assets. For example, utility companies typically have a high, acceptable gearing ratio since the industry is regulated. These companies have a monopoly in their market, which makes their debt less risky companies in a competitive market with the same debt levels. Capital gearing is a British term that refers to the amount of debt a company has relative to its equity. In the United States, capital gearing is known as financial leverage and is synonymous with the net gearing ratio.

As shown by the table above, Walmart has reduced debt in its capital structure over the last five years, from 74% of the equity in 20X4 to just 60% of the equity in 20X8. This ratio is expressed as a percentage, which reflects how much of a company’s existing equity would be required to pay off its debt. There are several ways a company can try to indirectly manage and control its gearing ratio, usually by profit, debt and expense management. For this reason, it’s important to consider the industry that the company is operating in when analyzing it’s gearing ratio, because different industries have different standards. ABC has been recently hit by the competition and is looking for a loan from the bank. However, the bank has decided that its gearing ratio should be more than 4.

As such, the gearing ratio is one of the most popular methods of evaluating a company’s financial fitness. This article tells you everything you need to know about these ratios, including the best one to use. Shareholders’ equity is the portion of a company’s net assets that belongs to its investors or shareholders. The par value of shares, anything additional in capital, retained earnings, treasury stock, and any other accumulated comprehensive income all contribute to shareholders’ equity. This figure alone provides some information as to the company’s financial structure but it’s more meaningful to benchmark it against another company in the same industry.

As a simple illustration, in order to fund its expansion, XYZ Corp. cannot sell additional shares to investors at a reasonable price. Gearing refers to the relationship, or ratio, of a company’s debt-to-equity (D/E). Find out how to calculate a xero software, what it’s used for, and its limitations.

For instance, it does not consider a company’s profitability or cash flow, which are critical factors in assessing a company’s ability to repay its debts. Additionally, the company’s gearing ratio is a static measure that does not reflect changes in a company’s financial position over time. The gearing and solvency ratios are similar in that they both measure a company’s ability to meet its long-term financial obligations. However, the solvency ratio also considers a company’s cash flow, which is its capacity to produce sufficient funds for immediate and long-term commitments. You can calculate this ratio by dividing a company’s after-tax net operating income by its total debt obligations, providing a more comprehensive picture of its financial health. The company has long-term debt of $10 million, short-term debt of $5 million, and shareholders’ equity of $15 million.