Statement of Retained Earnings: A Complete Guide

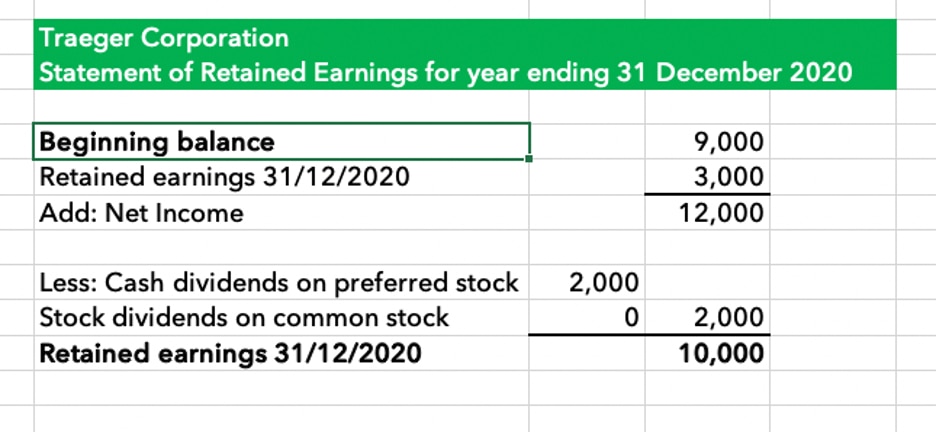

This is why you need to calculate retained earnings when building a three-statement model, even though you don’t necessarily need to model the entire statement separately. The statement of retained earnings—what we’re focusing on today—tells you how much of the current year’s earnings were distributed as dividends and find strength in your numbers this tax season reinvested into the business. Retained earnings are typically used for reinvesting in the company, funding growth opportunities, repaying debt, purchasing assets, or building a reserve against future losses. Retained earnings reports serve as crucial communiqués in the dialogue between a company and its shareholders.

How to find retained earnings on a company’s balance sheet

The statement of retained earnings is also called a statement of shareholders’ equity or a statement of owner’s equity. However, company owners can use them to buy new assets like equipment or inventory. It’s often the most important number, as it describes how a company performs financially. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington.

Example 1: Forecasting Revenue Growth

If your business recorded a net profit of, say, $50,000 for 2021, add it to your beginning retained earnings. A) They are not necessary and can be omitted.B) They provide a basis for forecasting and scenario analysis.C) They guarantee accurate financial results.D) They are used only for historical data. COGS projections, often a percentage of revenue, have a direct effect on gross margins and overall profitability. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Our Services

In that case, the company may choose not to issue it as a separate form, but simply add it to the balance sheet. It’s also sometimes called the statement of shareholders’ equity or the statement of owner’s equity, depending on the business structure. It’s also sometimes called the statement of shareholders’ equity or the statement of owner’s equity, depending on the business structure. Financial statement modeling is a key skill in the CFA curriculum, primarily used to project a company’s future financial performance based on historical data. This process involves building a model that integrates the income statement, balance sheet, and cash flow statement into a cohesive framework. The model serves as a critical tool for forecasting future earnings, assessing financial health, and supporting valuation decisions.

But, don’t forget, dividends are a slice out of your profit pie, directly nibbling away at your retained earnings. By now, you might appreciate the seamless interaction between the income statement and statement of retained earnings—an ensemble cast where each has a vital role in telling the financial story. Factor in net income like a maestro weaving a melody through the chords of retained earnings, carefully balancing the scales of income and expenses. This ending retained earnings balance can then be used for preparing the statement of shareholder’s equity and the balance sheet.

Retained Earnings to Market Value

Discuss your needs with your accountant or bookkeeper, because the statement of retained earnings can be a useful tool for evaluating your business growth. A statement of retained earnings shows the changes in a business’ equity accounts over time. Equity is a measure of your business’s worth, after adding up assets and taking away liabilities.

- The net income paid out to investors as dividends are one piece of information in which external stakeholders are interested.

- Here’s where eyes tend to linger and decisions begin to form based on how the numbers play out.

- Pour too much into dividends, and the retained earnings dwindle, possibly signaling a lack of internal investment capital.

- The model serves as a critical tool for forecasting future earnings, assessing financial health, and supporting valuation decisions.

- Now it’s time to walk through the calculation and see how Widget Inc. updates its retained earnings to reflect the year’s financial story.

Revenue is nothing but a high-five until you subtract the costs it took to rack up those sales. Here is an example of how to prepare a statement of retained earnings from our unadjusted trial balance and financial statements used in the accounting cycle examples for Paul’s Guitar Shop. If the company is not profitable, net loss for the year is included in the subtractions along with any dividends to the owners. Although this statement is not included in the four main general-purpose financial statements, it is considered important to outside users for evaluating changes in the RE account.

It generally limits the use of the prior period adjustment to the correction of errors that occurred in earlier years. While the intent of the appropriation requirement is to maintain the debtor’s solvency, it does not work nearly as well as the more specific restrictions. If you’re in a partnership, the IRS won’t accept your tax return unless you also attach Schedule K-1 of Form 1065. Retained earnings refer to any of an organization’s profits that it keeps for internal use. Learn about the Waste Book, why it’s the oldest book in accounting and how it’s still relevant today.

This modeling can help identify periods of cash shortfall and inform strategies for managing working capital effectively, ensuring the business can meet its obligations. A big retained earnings balance means a company is in good financial standing. Instead, they use retained earnings to invest more in their business growth. Most financial statements have an entire section for calculating retained earnings. But small business owners often place a retained earnings calculation on their income statement. Lower retained earnings can indicate that a company is more mature, and has limited opportunities for further growth, but this isn’t necessarily a negative.