Functional balance sheet for financial and accounting analysis: definition, example and Excel template

The preparation of the balance sheet is on the same pattern as of the trade entities. Assets are depicted on the right-hand side, whereas the liabilities are depicted on the left-hand side. A budgeted balance sheet is nothing the same as your current balance sheet, except that it reflects an estimate for future budget periods. It forecasts and gives you a view of where your balance sheet accounts will be at the end of future accounting periods if you stick to your current budget. Your balance sheet can help you understand how much leverage your business has, which tells you how much financial risk you face.

Profit and Loss Statement (Income Statement)

- Balance sheets are useful tools for individual and institutional investors, as well as key stakeholders within an organization, as they show the general financial status of the company.

- All the above are mentioned balance sheet items are also known as characteristics of the balance sheet.

- Shareholder equity is the money attributable to the owners of a business or its shareholders.

- While stakeholders and investors may use a balance sheet to predict future performance, past performance does not guarantee future results.

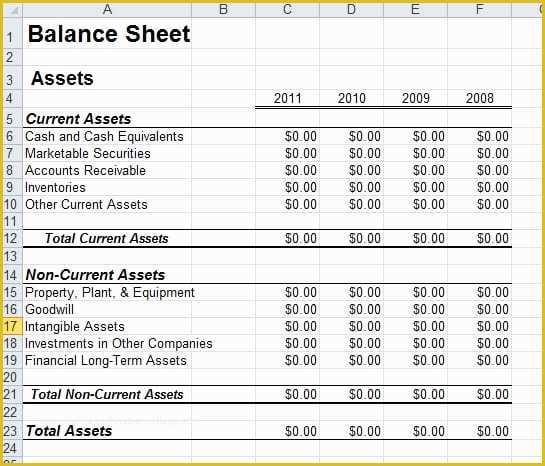

- All assets that are not listed as current assets are grouped as non-current assets.

Ask a question about your financial situation providing as much detail as possible. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Balance sheets also play an important role in securing funding from lenders and investors.

C. Equity

For instance, if someone invests $200,000 to help you start a company, you would count that $200,000 in your balance sheet as your cash assets and as part of your share capital. Shareholder’s equity is the net worth of the company and reflects the amount of money left over if all liabilities are paid, and all assets are sold. In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years.

C. Profitability Ratios

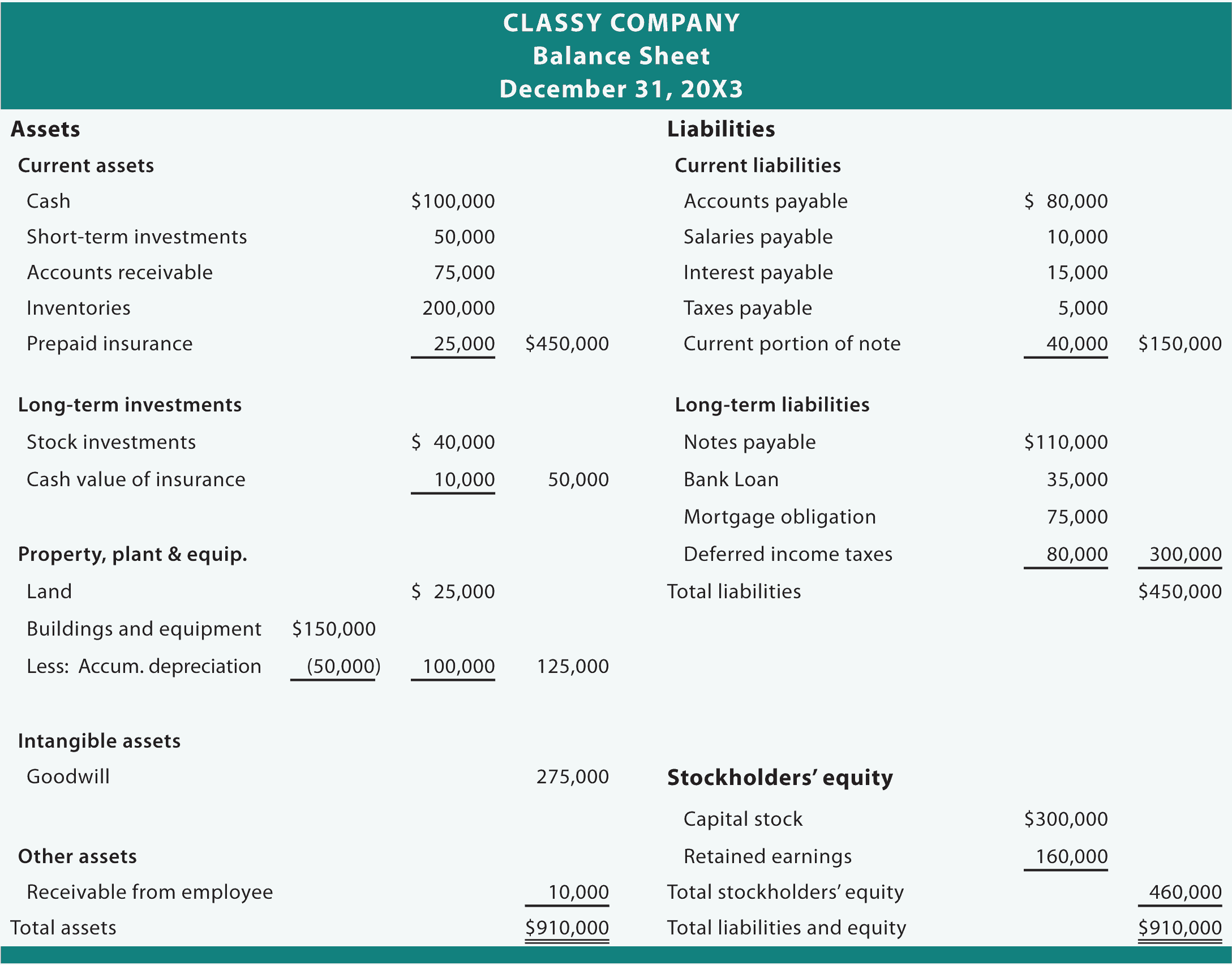

These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios. A balance sheet, along with an income statement and cash flow statement, is an integral part of your financial reporting.

This category includes readily available funds in the bank, inventory stock, and accounts receivable, which is money owed to the company by its customers. These assets are crucial for ensuring a company’s liquidity and its ability to meet short-term obligations. It’s important to consider industry benchmarks when interpreting balance sheets. Different industries have different financial ratios, capital structures, and operating norms. By comparing a company’s balance sheet to industry benchmarks, you can assess its performance relative to its peers. By looking at the changes in different items over time, like assets, liabilities, and equity, you can better grasp the company’s financial balance sheet performance and spot any trends.

Grouping refers to putting similar items with similar qualities together and showing them under a common head inside financial statements. For example, all the debtors of an organisation are grouped together under just 1 head of sundry debtors order of liquidity in the balance sheet. Similarly, Inventory shows the net total of Raw Material, Work In Progress and Finished Stock. The difference between a company’s total assets and total liabilities results in shareholders’ equity (or “net assets”).

It is unsuitable for submitting to Companies House but will enable small businesses to produce a report for their year-end. If you are a limited company, you will need your accountant to format the report as part of your accounts to submit to Companies House. This ensures that the financial report adheres to the generally accepted accounting principles. Cash flow statements track a company’s financial transactions, showcasing money flow in and out during a specific timeframe.

Depending on the company, different parties may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and then looked over by an external accountant. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report.

The Balance Sheet—or Statement of Financial Position—is a core financial statement that reports a snapshot of a company’s assets, liabilities, and shareholders’ equity at a particular point in time. Assets represent things of value that a company owns and has in its possession, or something that will be received and can be measured objectively. Liabilities are what a company owes to others—creditors, suppliers, tax authorities, employees, etc. They are obligations that must be paid under certain conditions and time frames. One thing to note is that just like in the accounting equation, total assets equals total liabilities and equity.